Mastercard has unveiled their newest offering at the Money 20/20 exhibit in Las Vegas, this is the world’s largest payments and financial services innovation event. This is a new chatbot AI platform which allows payment cardholders to conduct transactions, manage their finances and shop online using various messaging apps and platforms.

The Mastercard Chatbot Is an Innovative Feature

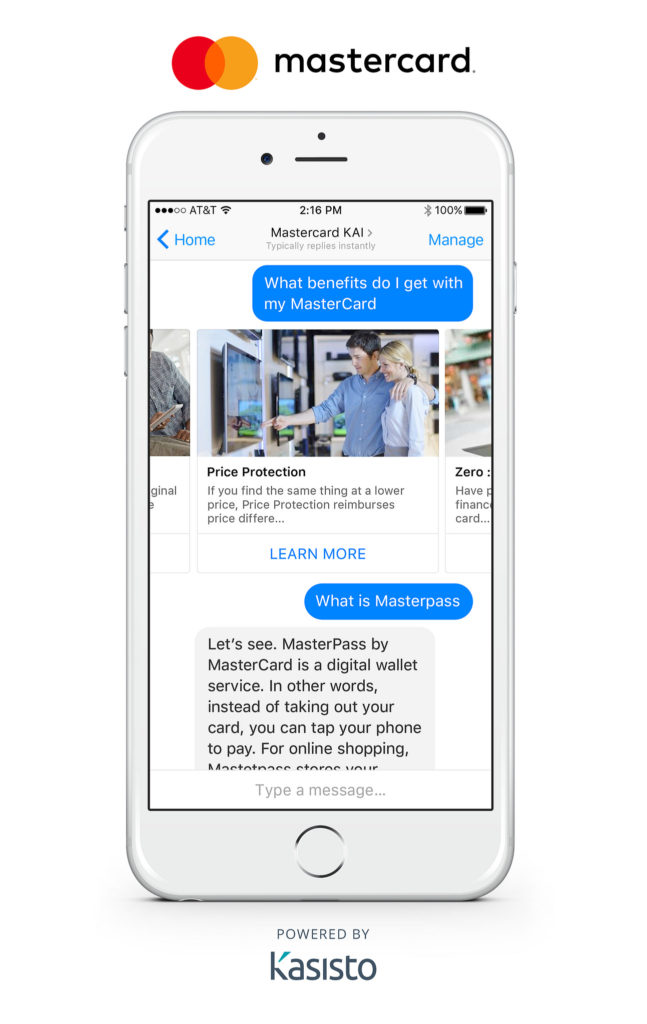

Mastercard will bring the chatbot to the consumers by using some of the most popular communication channels – messaging apps like Facebook Messenger and traditional SMS messages. The bot is supported by KAI Banking, a well-known AI platform that has invested a lot in the field of financial services. The innovative feature will allow online banking through the chat messages with the artificial intelligence. The aim of the company is to make financial operations more natural by employing a method which relies on conversations with the Chatbot.

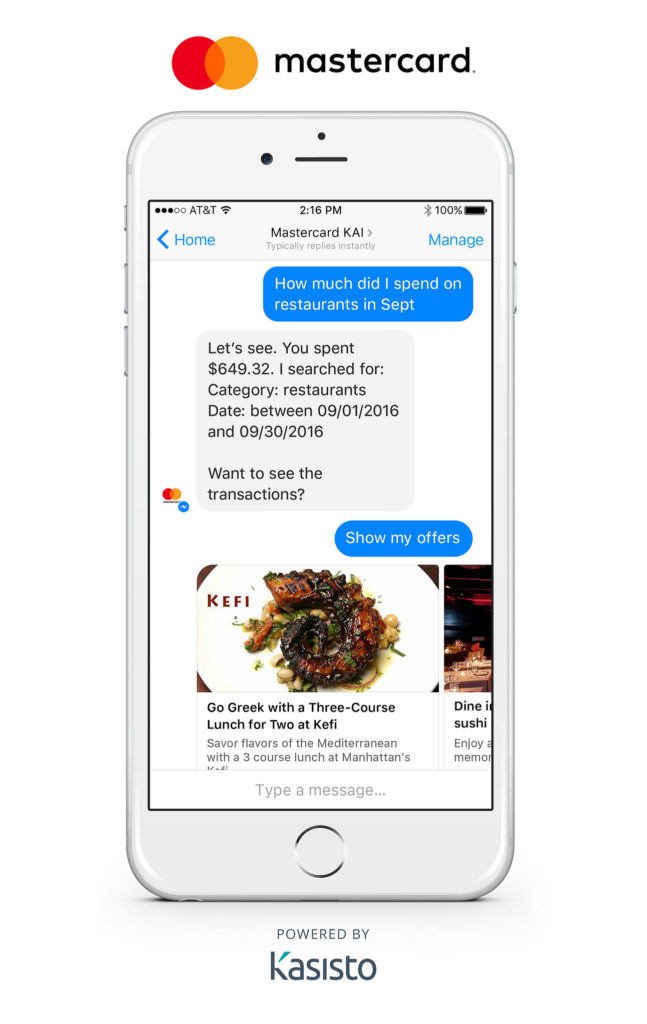

From the beginning of the next year Mastercard customers in the USA will be able to start using the service by asking questions that are related to their bank accounts, history of transactions, expenses and other information. In addition they we will be able to receive customized and special offers from Mastercard and their banks.

The Mastercard Chatbox for Business Owners

The Chatbot will also be useful for business owners or online shops. Customers will be able to communicate with the AI and make online orders and pay using the digital payment service Masterpass. Mastercard are working with a variety of different industries and retail to provide different services to the consumers – air tickets, fashion, technology products and more. This means that customers will be able to buy their desired items without typing in their payment card details or opening up payment apps. Mastercard is also going to provide a software development kit to aid developers in supporting the banking AI.

What Does This Mean for Mastercard Customers

The new feature will allow a never seen before integration between digital payments and messaging services. The new generation of users uses the messaging apps every day and for some of them it feels unnatural to pay for services and products by entering credit card details in online forms. This latest move from Mastercard will help alleviate this issue by providing an elegant solution.

Of course, we cannot miss to note – there are some serious privacy and security concerns, however at this point there is not much information available about the technical implementation of the project. So we will just have to wait and see what kind of problems might pop up.